Family Office Insider (FOI) | April 2025

📰News, 📑Research & Reports, 📅Events, 👥Jobs Board | Family Office Industry Newsletter

Hello, and welcome to the 4th edition of 2025 of Family Office Insider (FOI). In the Industry Newsletter each month we share the latest news and developments from the family office ecosystem. Welcome to 93 new subscribers this month!

Sections:

📊 Chart of the Month

📑 Research & Reports

📰 News & Commentary

👥 Jobs Board

📅 Events

📊 Chart of the Month

Powered by GPFO Research

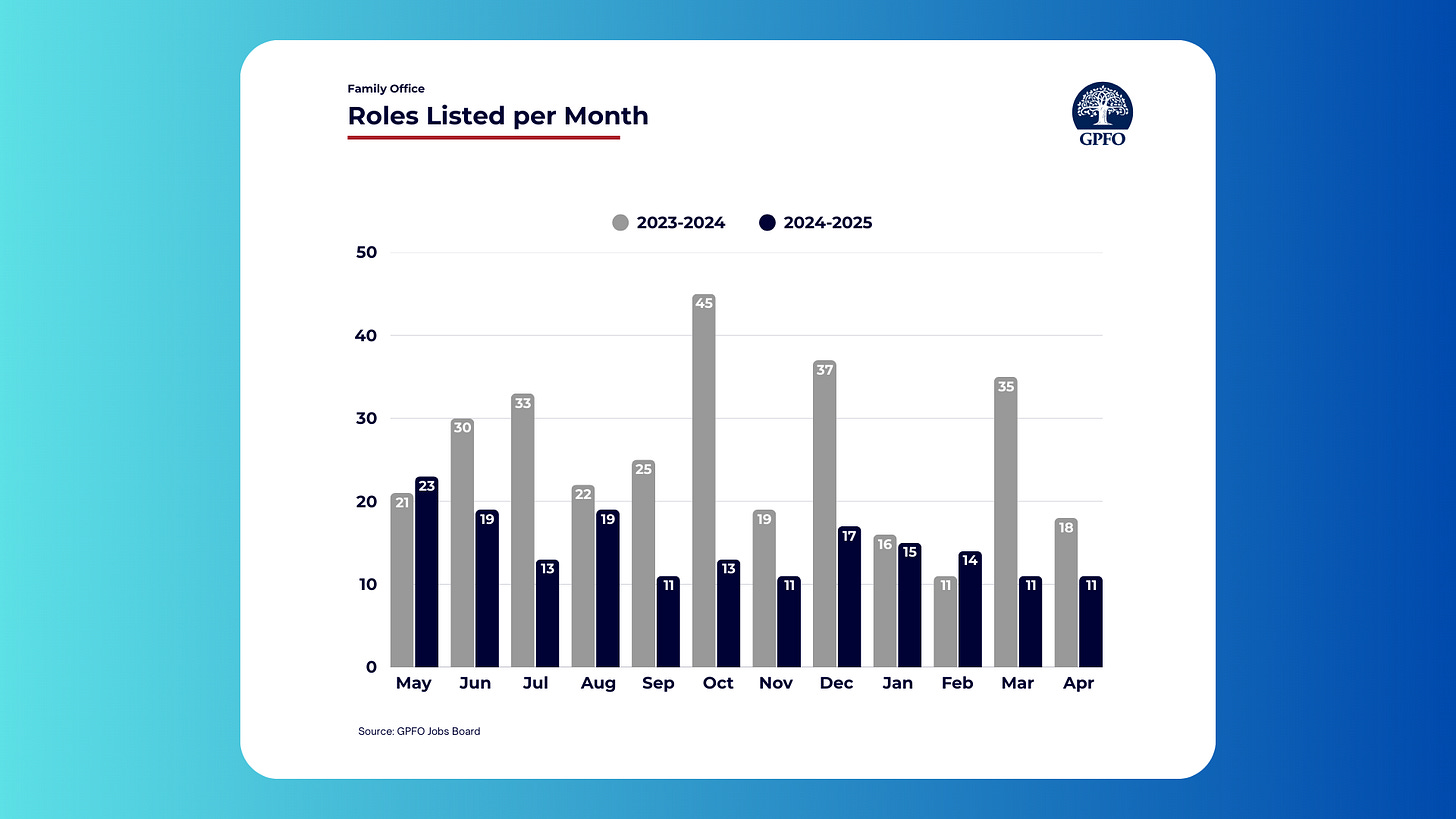

This month’s 📊 Chart of the Month shares data on activity in family office recruitment from 498 roles listed on the GPFO Family Office Jobs Board since May 2023. It represents only roles in single family offices and private multi-family offices. The chart compares the number of roles in single family office listed monthly over the past 24 months. Overall, there was a significant peak in role listings in October and March of 2023-2024, while listings in 2024-2025 have shown more stable and consistent numbers throughout the year. Notably, the highest listing months in 2024-2025 are May and June, reflecting an earlier hiring trend compared to the previous year.

Fresh insights on family office recruiting (see 2024 Insights) were published to members and premium subscribers on 9th April 2025.

📑 Research & Reports.

The latest reports, research and whitepapers on family offices, global wealth and select interest areas. Powered by the GPFO Research & Reports Database.

Report | The Fireside: A Family Office Case Study Collection, 2025, Deloitte

Outlook | 2025 Sustainable & Impact Investing Outlook, Glenmede

Report | Global Investment Returns Yearbook 2025, UBS

Report | Global Private Equity Report 2025, Bain & Co

Report | Global Private Markets Report 2025, McKinsey & Company

Research | VC Fund Performance FY2024, Carta

Research | EQuilibrium Global Institutional Investor Survey 2025, Nuveen

Report | Global Secondary Market Review, Jefferies

Family Office Secondaries Forum | 24th April

Academic | The Meritocratic Illusion: Inequality and the Cognitive Basis of Redistribution. IZA Institute of Labor Economics

Academic | What is the Future of Institutional Investing? Richard M. Ennis

“Alternative investments, or alts, cost too much to be a fixture of institutional investing. A diverse portfolio of alts costs at least 3% to 4% of asset value, annually. Institutional expense ratios are 1% to 3% of asset value, depending on the extent of their alts allocation… CIOs and consultant advisors, who develop and implement investment strategy, have an incentive to favor complex investment programs. They also design the benchmarks used to evaluate performance. Compounding the incentive problem, trustees often pay bonuses based on performance relative to these benchmarks. This is an obvious governance failure. The undoing of the endowment style of investing will not happen overnight.”

What is the Future of Institutional Investing?, Richard M. Ennis

News.

📰 Headlines

What lies behind the dramatic shift in markets. FT

“Druckonomics” shaping US economic order. FT

Sports investing continues its march: SF Giants sell off 10% stake to Sixth Street. ESPN

Cybersecurity in the family office is hard, but at least you didn’t add a journalist to your Signal group chat this month. Atlantic

For our non-US readers: It’s a WhatsApp world at work now. FT

New York art adviser sentenced to prison for fraud. The Art Newspaper

AlTi Tiedemann acquires Kontora to expand German market presence. Press Release

🏕️ Family Offices

The hidden dangers of family offices. FT

The role of family meetings. J.P.Morgan

LVMH taps Arnault’s son to head Loro Piana in leadership reshuffle. WSJ

Stephen Lansdown’s & Tom Scott’s family office back acquisition of Oak Group. Bailiwick Express

Defence tech boom, makes Christian Hadjiminas a billionaire. Bloomberg

Lakshmi Mittal plans to leave UK after non-dom tax change. FT

Singapore family office hit by $55m fraud scandal. Nikkei Asia

Tribes form as Australia’s family office team-up in search of deal flow. Capital Brief

Family office dealmaking doubled in February with bets on crab shells, nuclear reactors and more. CNBC

How Olympus Ventures used drawdown funds, co-investment and secondaries to transition to private markets. Opto

💼 Career Moves

Nicola Forrest’s family office Coaxial, appoints ex-UBank exec Philippa Watson as first CEO.

Martin Bowen joins Weybourne, James Dyson’s family office, from Dyson. Bloomberg

Kristy Jones joins London-based Single Family Office as Head of Finance & Operations from MA Financial Group.

Mike Ramsay now vice chair of Prudence Macleod’s family office, Macdoch, after departure of senior investment staff. Bloomberg

Dharshi Wijetunga joins Jacobs Holding AG as Head of Tax and Wealth Structuring, from Charles Russell Speechlys.

Piers Davison joins Michael Spencer’s family office. Bloomberg

Daniel Baron joins Florida based Single Family Office as CFO, from Alvarez & Marsal.

Prashant Mahajan joins Riyadh based Single Family Office from Concentrix.

Michael Weichholz joins New York based Single Family Office from Schonfeld.

Blake Shorthouse joins Blue Owl from KKR to lead Family Office efforts.

✨ Impact & Philanthropy

GP Stakes in Impact Investing. Capricorn Investment Group

The Bill Gates era of Climate giving has ended. Heatmap

$50 Million Gift from the Weill Family Foundation Establishes the Weill Cancer Hub East. Press Release

SF Climate Week is this month. If you are visiting the Bay Area for it, drop a line to Hugo.

🤝 Private Markets

Research | Global Private Markets Fundraising Report 2024 Annual, Pitchbook

Podcast | Willgrow’s Justinas Milasauskas on turning peripheral roots into a global advantage.

Yahoo Finance launches private company insights in partnership with EquityZen & Forge Global. Yahoo

China to set up national venture capital guidance fund. Reuters

The returns of venture capital are different. Klement on Investing

The world’s first “biological computer”. New Atlas

Europe’s defense-tech startups launch into new era of growth. Pitchbook

👥 Jobs Board.

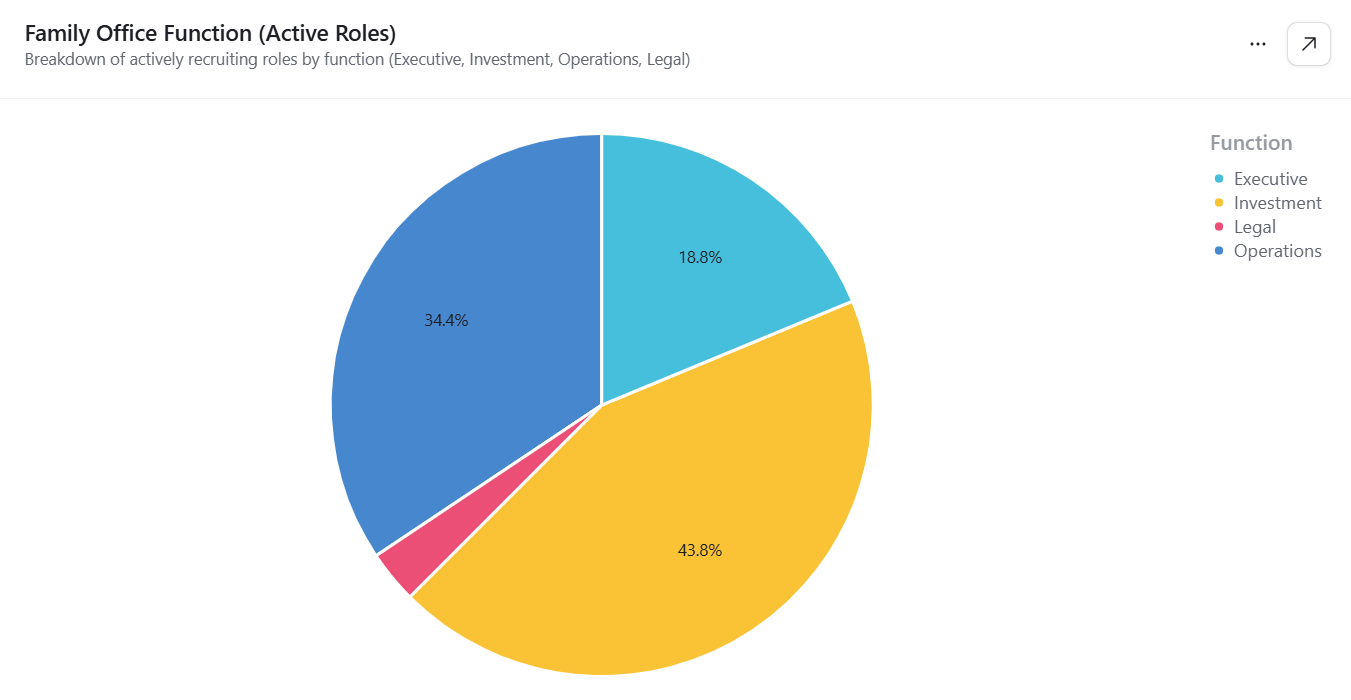

Full Jobs Board accessible via the industry or members portals. Currently 32 actively recruiting roles in single family offices. 11 new roles listed this month, 9 closed to new applications. Hiring?

Chief Investment Officer - Single Family Office - Palm Beach, USA

Chief Financial Officer - Single Family Office - Gibraltar

Head of Investment and Trading - Single Family Office - Hong Kong

Head of Finance - Single Family Office - Singapore

Investment Manager (Private Markets) - Single Family Office - Munich, Germany

Senior Associate - Single Family Office - Dubai, UAE

Senior Investment Professional (Growth & PE) - Single Family Office - Abu Dhabi, UAE

📅 Events.

Private Briefings | World Gold Council - Zurich, 2nd April | Geneva, 3rd April. Request place on waitlist

Family Office Secondaries Forum | 24th April - London Stock Exchange & Online. Request Invite

Spring Drinks | 30th April - London. Request Invite

Save the Date | GPFO European Conference 2025 - 5th November.