📢 Announcement: Launching the Industry Portal.

Thank you to all those that signed up to beta test our new industry portal. The feedback and suggestions have been hugely valuable and we are delighted to launch the portal this week.

At a glance:

Hugo King-Oakley reviews and analyses how family offices make investment decisions, alongside the most recent research and report data.

How are investment decisions different in family offices vs institutions?

We at GPFO get asked about the nuances of investment decision-making in family offices. The surface-level answer is 'every family office can be different', but why?

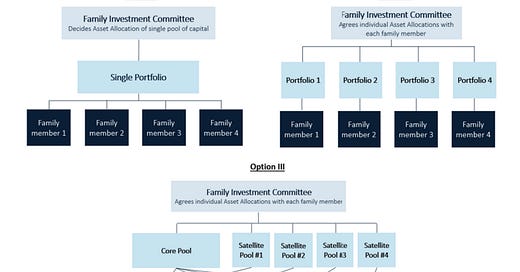

When it comes to investment decision-making, family offices and institutions operate within often distinct frameworks that are influenced by their unique characteristics and objectives. While there may be similarities in their approach to investments, understanding the nuances between the two can shed light on the factors that differentiate them. In this piece, we will explore the key differences in investment decision-making between family offices and institutions and delve into why every family office can be different.

Purpose and Ownership Structure:

Family offices are private wealth management entities established to manage the financial affairs and investments of high-net-worth families. They are typically established by affluent families to preserve, grow, and transfer wealth across generations. The primary objective of a family office is to align investment strategies with the family's long-term goals, which can vary greatly depending on their values, risk tolerance, and intergenerational wealth transfer plans.

Keep reading with a 7-day free trial

Subscribe to Family Office Insider (FOI) to keep reading this post and get 7 days of free access to the full post archives.